Bitcoin is flashing signs of momentum strength amid rising institutional and retail demand. With the psychological $100k mark on the cards, what can you expect?

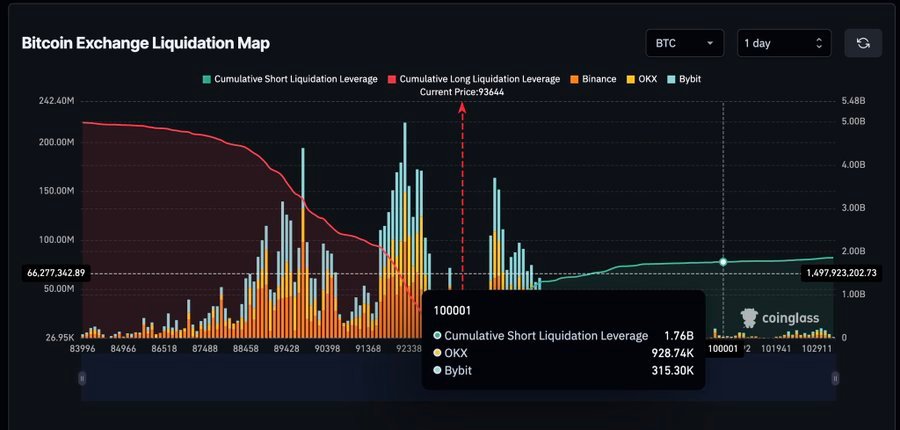

Bitcoin’s path to $100,000 is not just a psychological relief or symbolic milestone for crypto enthusiasts, but also a minefield for BTC’s short sellers. Recent Coinglass data has revealed a key liquidation pool lying ahead as bulls rally for the $100k mark.

According to the data, if Bitcoin rallies to reclaim this six-figure mark, short positions worth $1.76 billion across exchanges like OKX and Bybit will be instantly wiped. A breakout above this level could ignite further liquidations of over-leveraged bearish positions.

The exchanges mentioned above hold significant bearish trades around this level, and a brutal short squeeze could result as bears seek cover. With high buying pressure from them, this could fuel BTC’s price even higher to a new all-time high. Traders are closely watching the $100 mark in anticipation of volatility fireworks.

[…] is signaling strength and could be eyeing a bull run towards the $100k key psychological zone. BTC is trading at around $95,994 as of press time, per CoinMarketCap […]

[…] with a nearly 1% increase in price over the past 24 hours, per CoinMarketCap. Bitcoin’s path to 100k could trigger major liquidations and some market […]