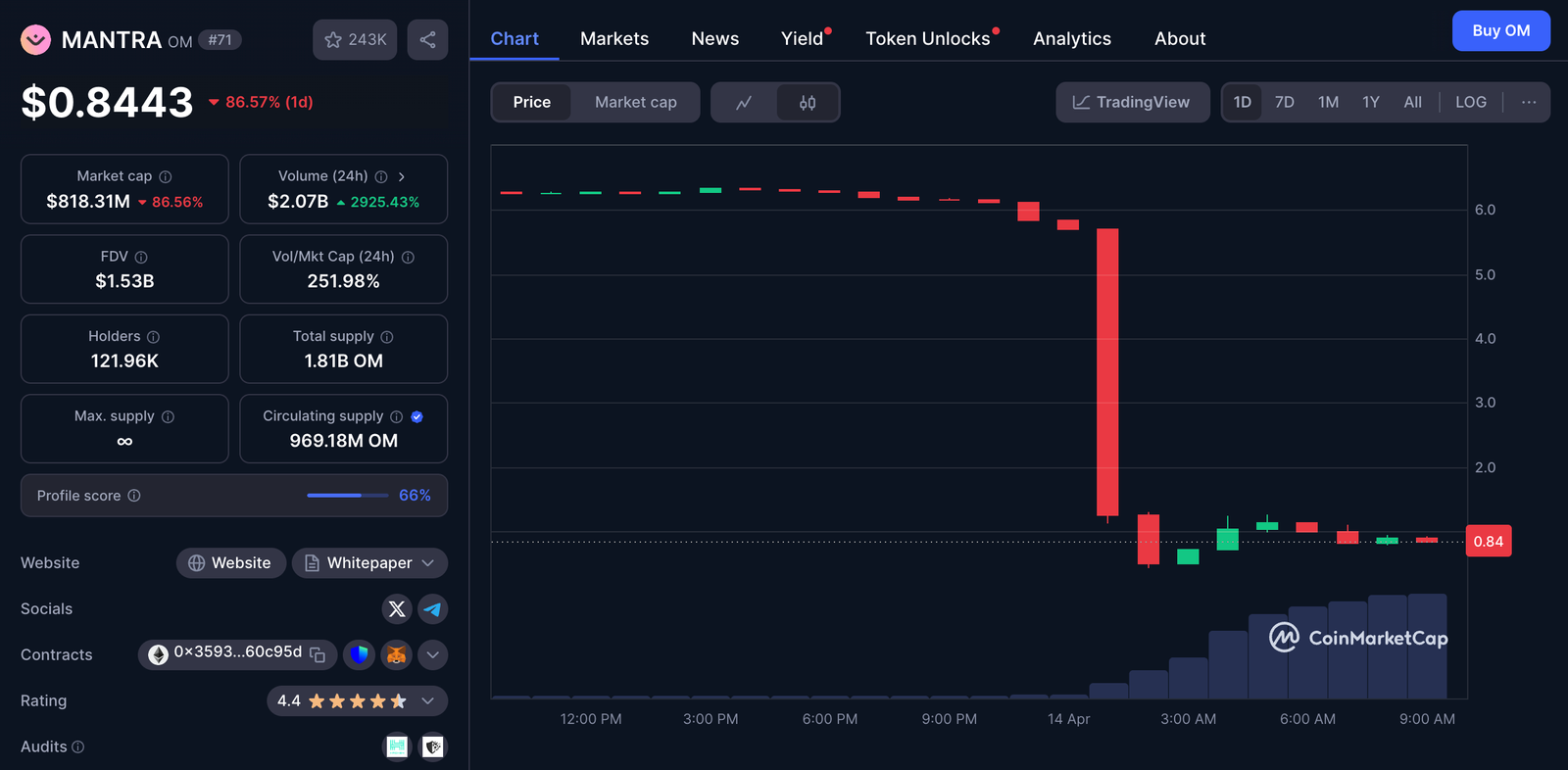

Mantra’s token, OM, crashed 90% amid forced liquidations, wiping out over 5.5 billion in market cap in a few hours.

April 13th- Mantra, the layer-1 blockchain ecosystem focusing on regulated digital assets, saw its token OM crash 90% within 24 hours. With a sudden 5.5B market cap crash, allegations point fingers at the project’s team, sparking debate about its transparency.

Per the allegations, the team controlled 90% of OM tokens. As a result, they have been linked to centralization and compared to the 2022 Luna crash of a $60 billion blood bath in the Terra ecosystem.

A red flag observed by investors was a movement of 3.9 million OM tokens supposedly belonging to the OM team to the OKX exchange. With the rapid price drop, a domino effect happened, leading to further liquidations as the OM token plunged.

In response, the Mantra team claimed “reckless exchange liquidations” are to blame for the crash, denying any “rug pull” moves or insider actions. The OM crash serves as a reminder of the dark side of the crypto market, that is, any form of centralized control.